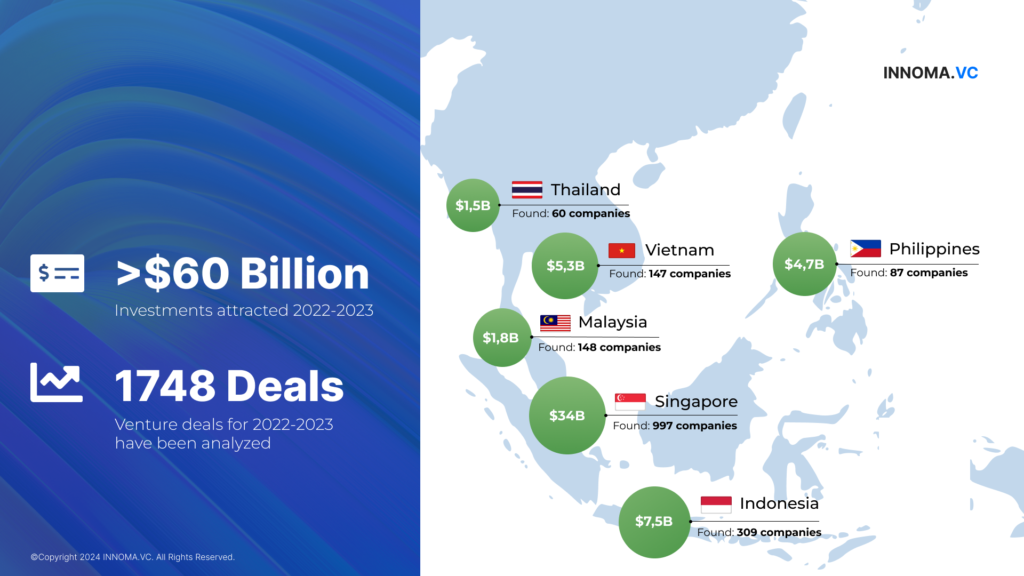

Our team at INNOMA.VC conducted an analysis of technology companies in Southeast Asia that attracted investments in the post-COVID era — in 2022–2023. For the review, we selected countries with the highest investment activity in the region: Singapore, Indonesia, Malaysia, Vietnam, the Philippines, and Thailand.

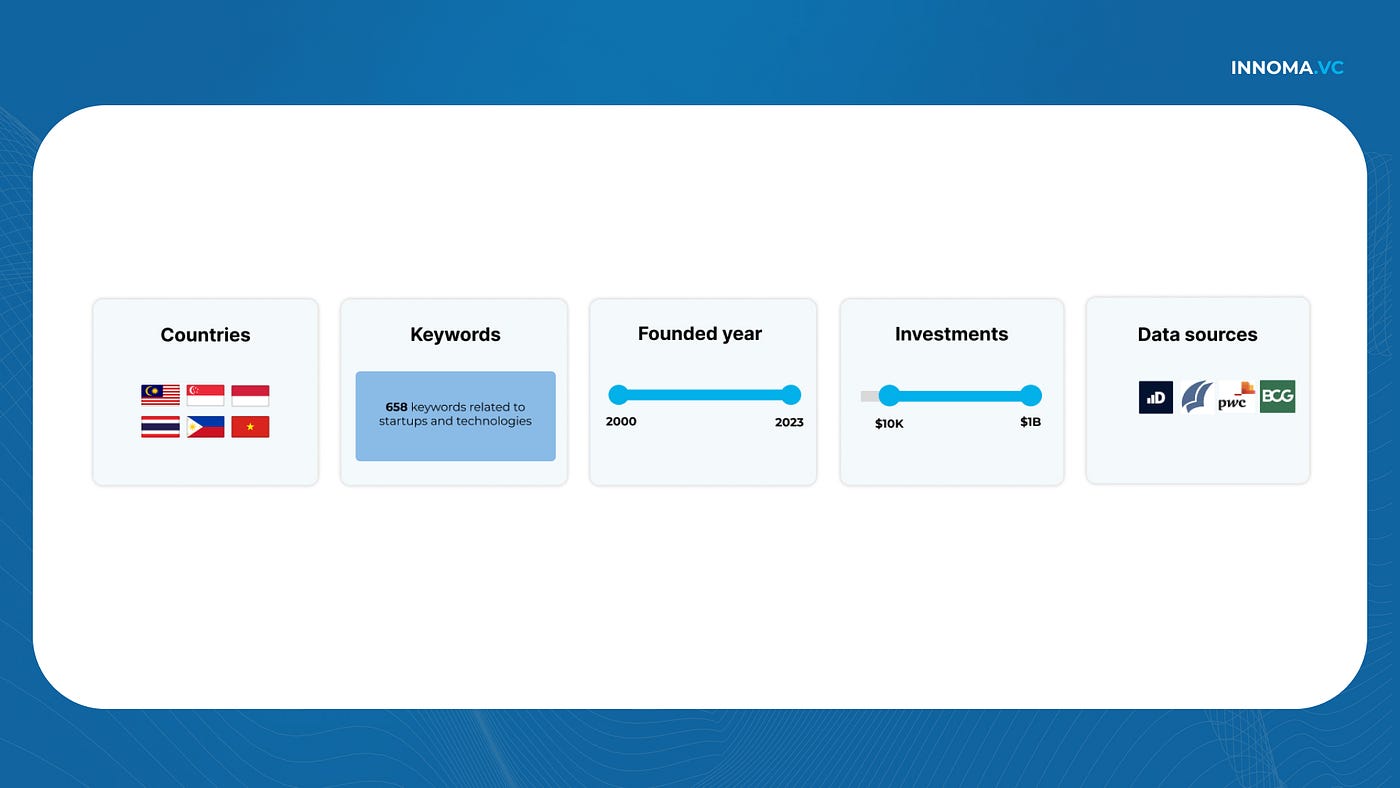

How the companies were selected

For creating the dataset, we used queries with more than 630 keywords related to innovation. We utilized analytical systems such as CBInsights, PitchBook, Dealroom, and local data aggregators FounderLairs and e27. The companies included in the study met the following criteria:

What was found?

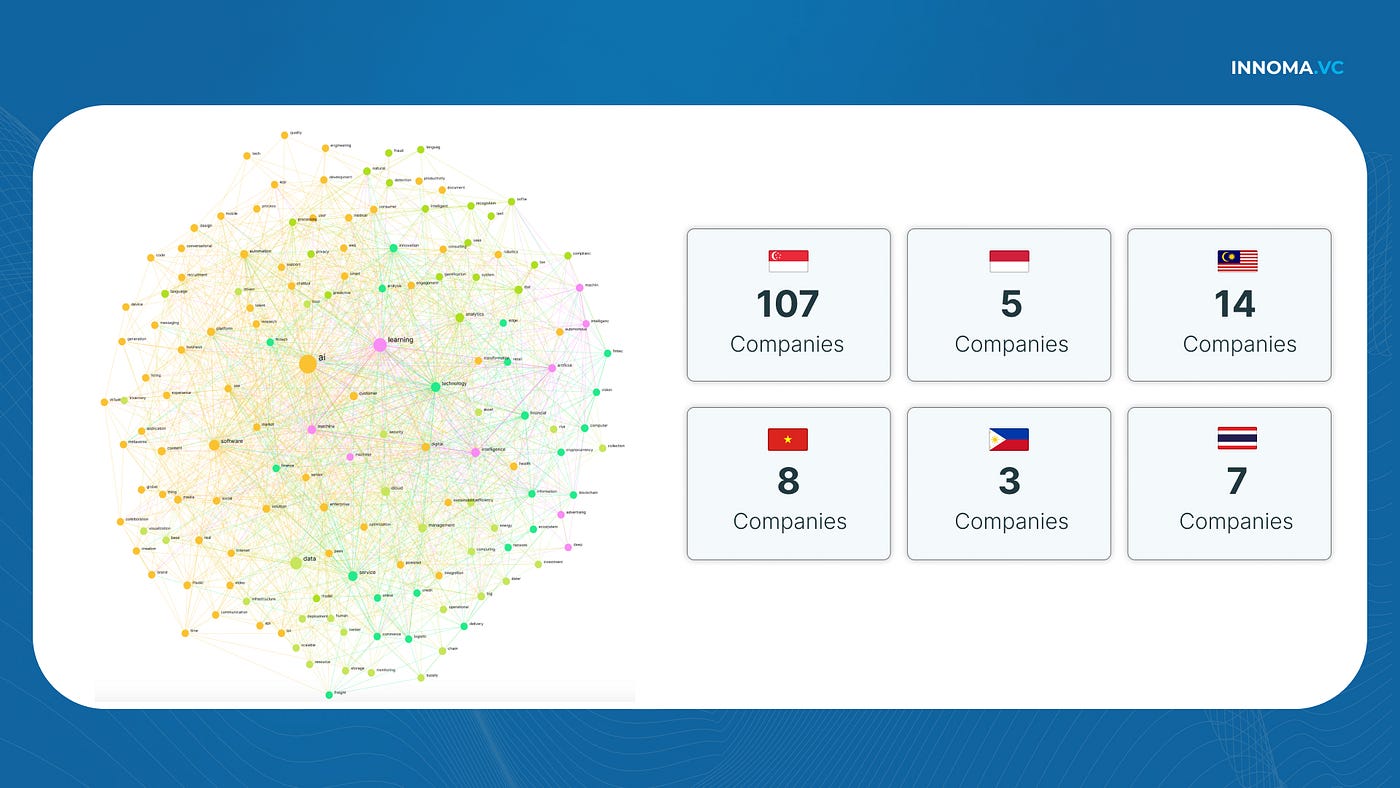

As a result, a sample of 1740 companies was formed, of which:

The total volume of investments amounted to $54.8 billion.

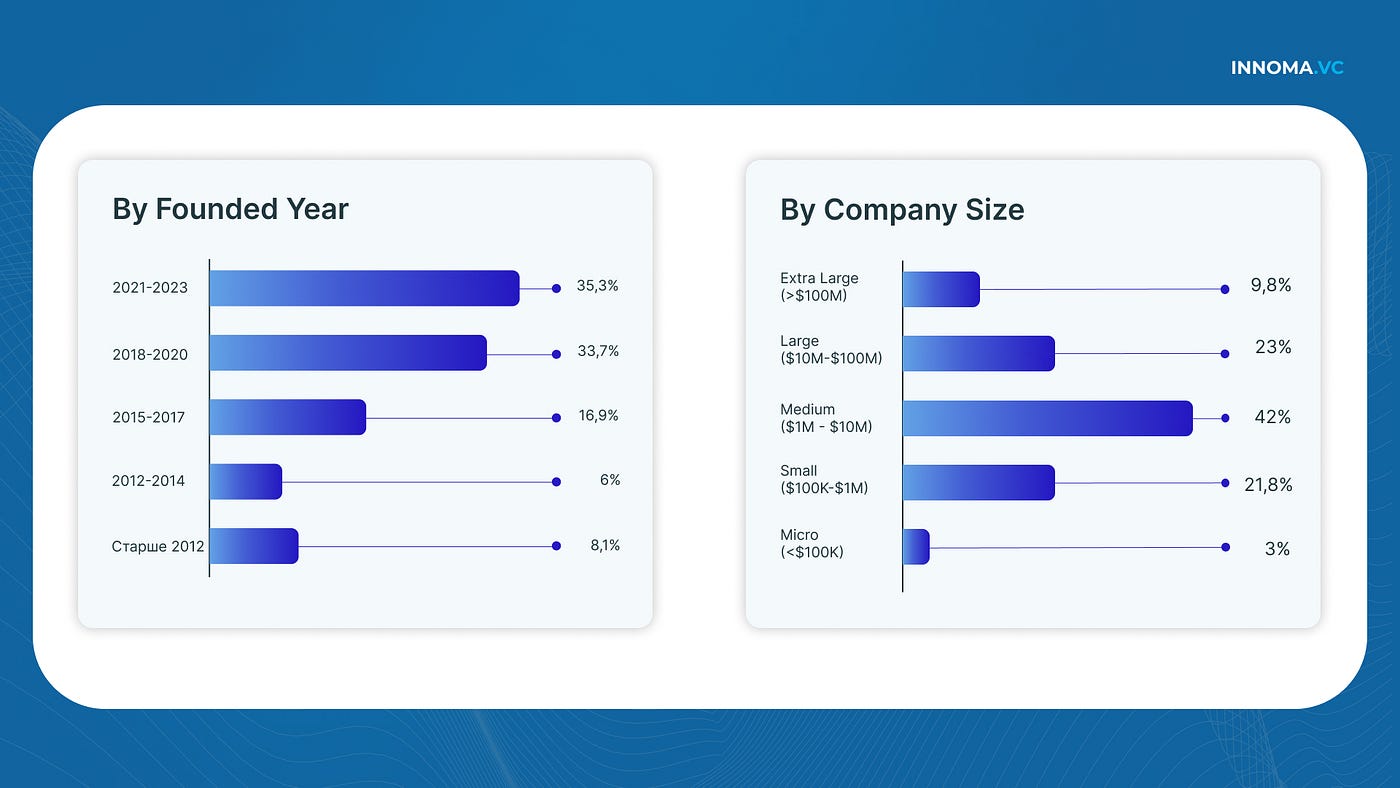

35% of the companies were established between 2021 and 2023, and over 60% of the companies have been operating in the market for no more than ten years. This indicator is characteristic of technology companies attracting venture capital investments.

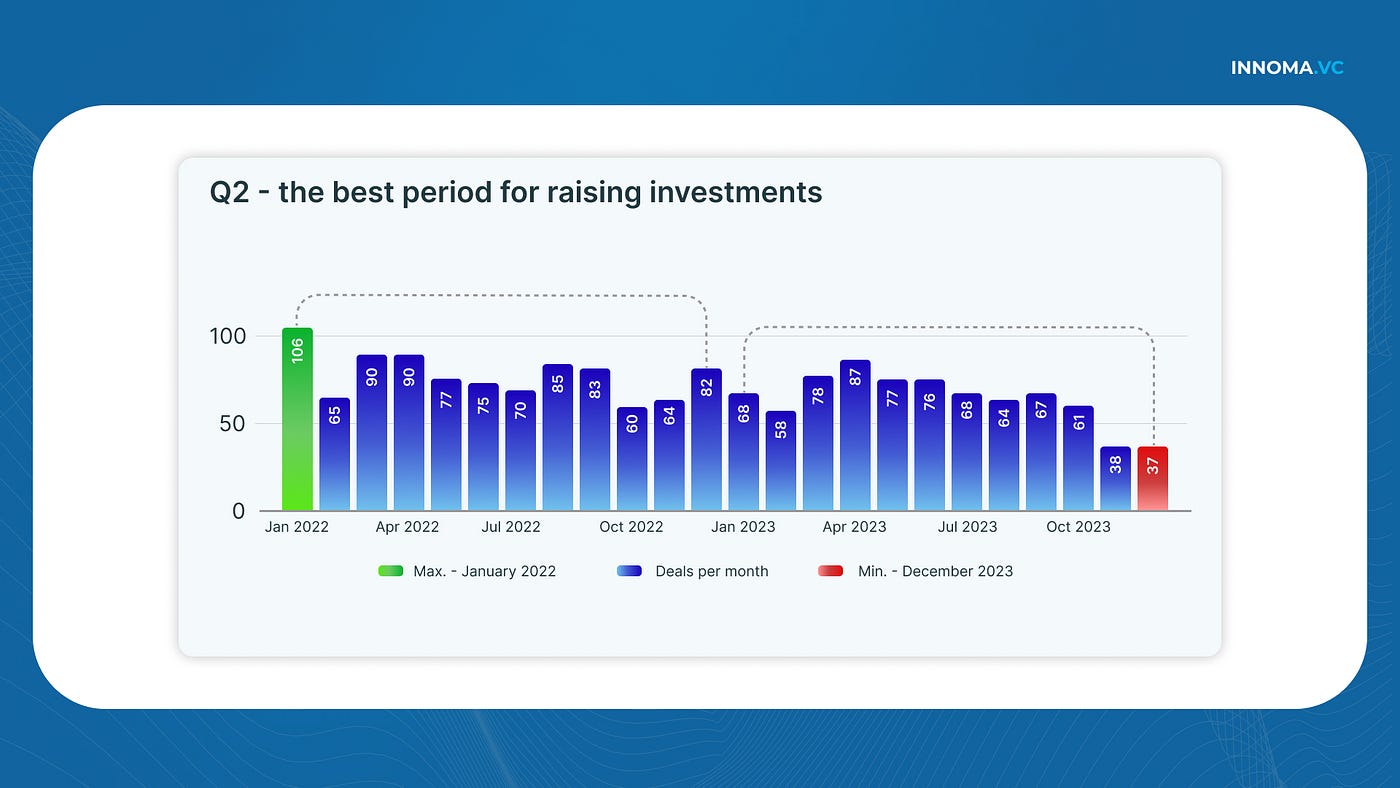

A detailed analysis of the monthly distribution of venture deals from 2022 to 2023 revealed a pattern: on average, there were 60 venture transactions each month in the Southeast Asia region. According to the data obtained, January 2022 was the most successful month. This month saw a peak in venture capital activity, with funding attracted by 106 companies.

It is noteworthy that the second quarter is the most optimal time for attracting investments. This period forms the main window of opportunity for seeking financial support for startups.

The last segment of the analyzed period paints a contrasting picture of the investment landscape. December and November of 2023 showed the lowest number of deals — with 38 and 37 transactions respectively. Compared to the same period of the previous year, 2022, we see a sharp twofold decrease in the number of deals and a noticeable seasonal decline in venture capital engagement.

In which sectors are Southeast Asian startups developing?

During our analysis, we identified 19 directions in which Southeast Asian startups are developing. The leading sectors include:

Thanks to our proprietary analysis methodology, we developed AI-Copilot — a tool designed to optimize the process of researching venture investments. By utilizing three applications of LLM models and our own AI engine, we were able to segment companies by 12 additional parameters, allowing for the formation of a 360-degree profile of a technology company.

This detailed analysis facilitated the classification of these companies into 19 industrial verticals, covering areas from FinTech and E-commerce to entirely new niches such as PetTech and SpaceTech. In data visualization, we use color markers to highlight the dominant industries in each country. Green is used for leading sectors, red for absent sectors, and yellow indicates areas with minimal transactional activity. It is noticeable that FinTech and E-commerce dominate the region, reflecting the overall trend of digital market growth in Southeast Asia.

Artificial Intelligence in Southeast Asia

An important trend in the technology sector of Southeast Asia is artificial intelligence (AI), 5G, blockchain, and Web3.0 becoming key drivers of development. The role of AI is particularly noteworthy: 149 companies in the region are actively exploring its capabilities. Detailed analysis helped to create a graphical model of the main AI technologies used in the region: machine learning, deep learning, natural language processing (NLP), computer vision, predictive analytics, neural networks, decision trees, and clustering.

Companies in the AI sector have attracted $2.5 billion in investments in the region. This underscores the critical role of artificial intelligence in innovation. The surge in AI investments demonstrates the growing popularity of data-driven strategies, automation, and intelligent solutions. The ultimate goal of these processes is to radically change industry norms and improve work efficiency.

Is the Southeast Asian market attractive?

The analysis of the dynamics of the venture capital market in Southeast Asia in the post-COVID era has shown a rapidly changing landscape with numerous investment flows and serious technological advancements.

A key center of innovation and investment is Singapore, accounting for almost half of the venture deals in the region. However, the distribution of investments across various sectors and countries reveals a diverse and vibrant ecosystem, full of opportunities for growth and innovation.

Today, Southeast Asia is one of the most dynamic and promising IT markets in the world. However, it still lags behind Russia by 5–7 years. The Deep Tech sector is underdeveloped in Southeast Asia. In this respect, Russia has a unique advantage — the country has formed a colossal scientific foundation of research papers and patents.

The scientific community in Russia in the field of IT technologies surpasses the Southeast Asia region in many parameters. This gives Russia opportunities to scale its technology companies and products into this region.

📊 Interactive version of the analytical research

📍List of Southeast Asian venture companies

Also, don’t forget to follow us for new valuable insights and strategic recommendations. We have a wide network of contacts among corporations, government structures, and startup communities throughout the Southeast Asia region.